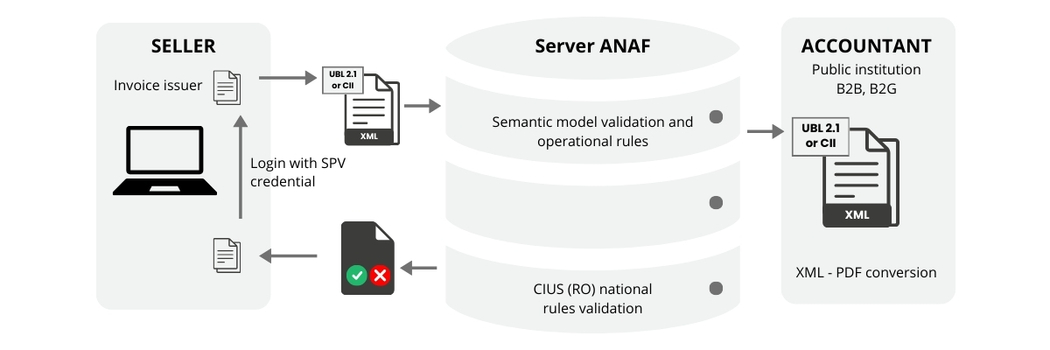

La factura electrónica es una factura que se emite, envía y recibe en un formato XML estructurado. Esta estructura le permite ser procesada electrónica y automáticamente por el sistema rumano de facturación electrónica, RO E-Factura.

Una vez finalizada la validación, el sistema genera automáticamente una respuesta y, si la validación es correcta, se aplicará la firma del Ministerio de Hacienda. De este modo se garantiza que el contenido de la factura no haya sido alterado.

La versión en papel estará permitida hasta el 30 de junio de 2024, excepto en el caso de que tanto el proveedor/prestador como el destinatario estén inscritos en el Registro de facturas electrónicas.

A partir del 1 de julio de 2024, en base a la modificación del artículo 319 de la Ley nº 227/2015, sólo las facturas emitidas electrónicamente en formato XML y transmitidas a través del sistema nacional sobre facturación electrónica RO E-Factura, serán aceptadas para su registro por el destinatario – sujeto pasivo establecido en Rumanía, en relación B2B.

El plazo para la presentación de facturas en el sistema nacional de factura electrónica es de 5 días hábiles a partir de la fecha de emisión de la factura, pero no más tarde de 5 días hábiles a partir de la fecha límite para la emisión de la factura prevista en el Art. 319 párrafo (16) de la Ley nº 227/2015. El incumplimiento de lo dispuesto constituye una infracción y se sanciona con multa. Como excepción, no se aplican sanciones desde el 1 de enero hasta el 31 de marzo de 2024.

Así, las entidades que incumplan la normativa corren el riesgo de ser multadas y de que se les deniegue la deducción del IVA.

Los contribuyentes deben prepararse con tiempo para cumplir estas obligaciones.

Deveho y Sage X3 están preparados para responder al nuevo sistema de informes E-Invoice.